maine tax rates compared to other states

Welcome to Maine FastFile. Maine also has a corporate income tax that ranges from 350 percent to 893 percent.

Maine Who Pays 6th Edition Itep

How high are sales taxes in Maine.

. The state sales tax rate in Maine is relatively low at 55 but there are no additional county or city rates collected on top of that. Office of Tax Policy. This tool compares the tax brackets for single individuals in each state.

These rates apply to the tax bills that were mailed in August 2022 and due October 1 2022. Tax Relief Credits and Programs. Instead it only uses the state tax rate of 55 percent.

Maine does not combine state and local taxes to calculate its sales tax rate. 51 rows Up to 25 cash back See how your states tax burden compares with other states. MEETRS File Upload Specifications.

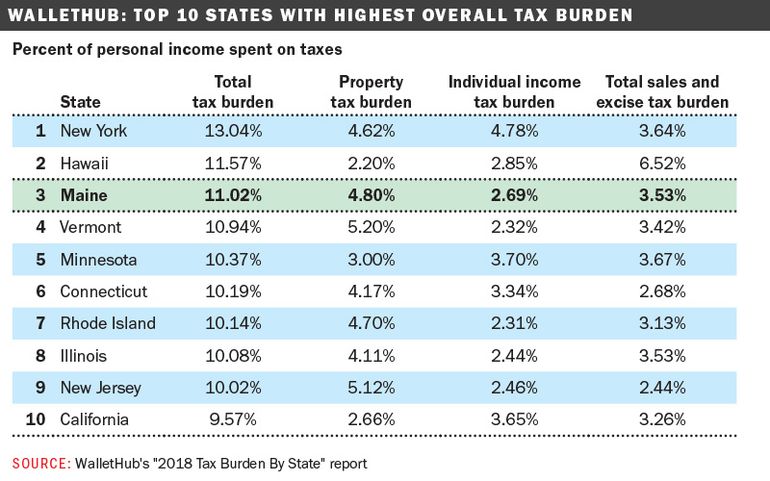

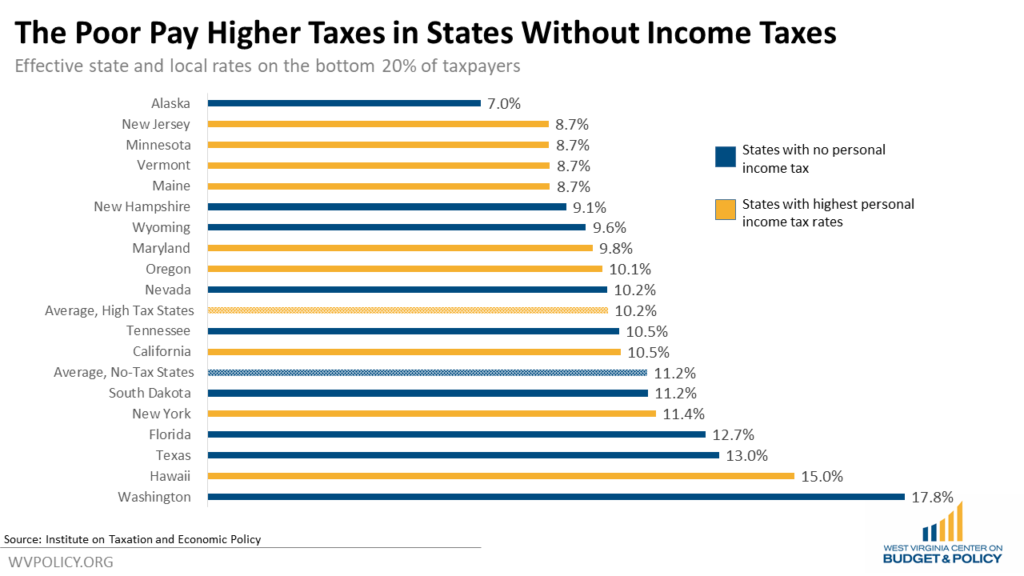

Maines percentage was 105 slightly more than the portion in Connecticut. The taxes were ranked as a percentage of total personal income in each state. Grow Your Legal Practice.

Use this tool to compare the state income taxes in Maine and North Carolina or any other pair of states. Real-Estate Tax Rank Effective Vehicle Property Tax Rate. 51 rows If you make 70000 a year living in the region of Maine USA you will be taxed 12188.

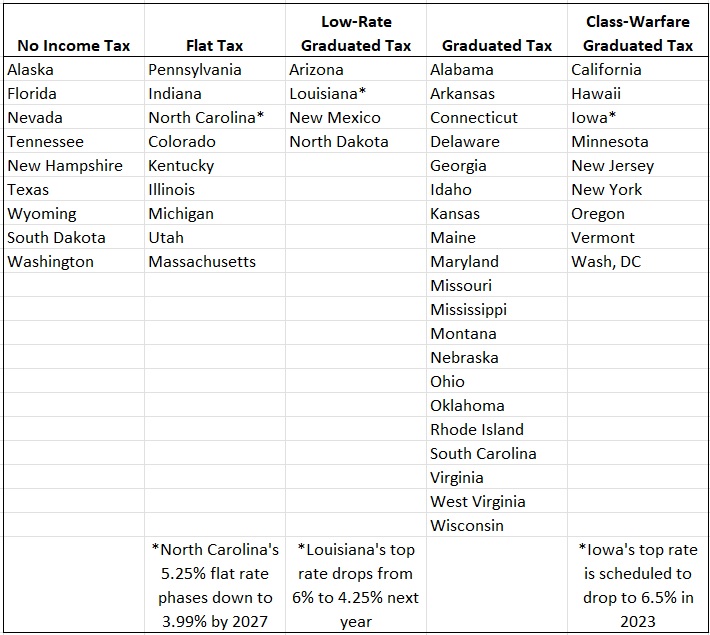

Maine Tax Rates Compared To Other States. Therefore 55 is the. According to the Tax Foundation the five states with the highest top marginal individual income tax rates are.

Other things to know about Maine state. California tops the list with the highest income tax rates in the countryits highest tax rate is 123 but it also implements an additional tax on those. Vehicle Property Tax Rank Effective Income Tax Rate.

20 for sales and excise taxes. Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent. This tool compares the tax brackets for single individuals in each state.

Effective Real-Estate Tax Rate.

Annual State Business Tax Burden Rankings Released Anderson Economic Group Ranks All 50 States Michigan Moves From 12th To 16th Anderson Economic Group

Ranking State Income Taxes International Liberty

State Income Tax Rates Highest Lowest 2021 Changes

Maine Sales Tax Calculator And Local Rates 2021 Wise

Sales Tax On Grocery Items Taxjar

Here Are The Cities With The Lowest Property Taxes In Maine

Minnesota Should Reduce Its Individual Income Tax Rates American Experiment

Historical Maine Tax Policy Information Ballotpedia

These States Have The Highest And Lowest Tax Burdens

Jon Coupal On Twitter From The Ca Dept Of The Obvious Proposed Corporate Tax Hike In California Could Drive More Businesses To Texas Https T Co Iqrz8kbcpr Via Sfbusinesstimes Twitter

Maine Property Tax Rates By Town The Master List

Maine Income Tax Brackets 2020

Which States Have The Highest Taxes On Marijuana Priceonomics

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

State Tax Rates Comparison Property Sales Income Social Security Tax

Tax Burden Per Capita Other State Austin Chamber Of Commerce

Tax Debates In U S Maine Focus On What Rich Should Pay

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

Eliminating The Income Tax Benefits The Wealthy While Undermining Important Public Investments West Virginia Center On Budget Policy